Gold Rate Today: What’s Creating the Hype and What Does It Mean for You

In India, gold holds a special place beyond being a valuable metal—it’s deeply intertwined with cultural heritage, traditions, and personal significance. From weddings to investments, it plays a pivotal role in our lives. But recently, there’s been a lot of chatter around the gold rate today, and for good reason. Prices have taken an unexpected dip, drawing the attention of investors, traders, and everyday buyers. Let’s take a closer look at what’s going on, why it’s happening, and whether this could be the right time to act.

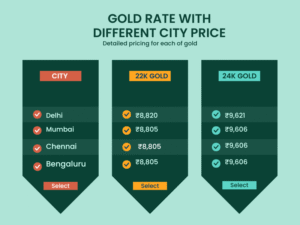

Gold Prices Today

Currently, 24-karat gold is selling for ₹9,393 per gram, while 22-karat gold is priced at ₹8,610 per gram. Just a week earlier, gold was being sold at a noticeably higher rate. for almost ₹9,960 per gram—a huge fall that has shocked many in the market.

lass=”yoast-text-mark” />>

In major cities such as:

Delhi: ₹9,420/gm (24K)

Mumbai: ₹9,393/gm (24K)

Ahmedabad: ₹9,611/gm (24K)

Chennai: ₹9,445/gm (24K)

This price drop is bringing forth two responses: buyers are becoming lured, and investors are getting worried.

Why Are Gold Prices Dropping?

Several major reasons are responsible for this sudden downward trend:

Global Economic Recovery: Indications of economic recovery in the U.S. Certain parts of Europe have seen reduced interest in gold as a safe-haven asset. When stock markets gain vigour, investors transfer funds away from commodities such as gold.le=”font-weight: 400;”>

>

Profit Booking: Following gold’s sharp rally during April and the initial part of May, several short-term investors decided to book profits, unleashing a bout of selling that dragged prices down.

>

Stable Dollar Index: A stronger U.S. dollar tends to pressure gold prices around the world, and that phenomenon is now visible in local markets as well.

Geopolitical Cooling: Following a temporary deflation of geopolitical tensions, the need to hedge with gold has reduced.

Expert View: What’s Next for Gold?

Experts are split but generally cautious in the short run. Experts advise gold prices can dip further, perhaps to test the ₹90,000 per 10 grams level before a stabilisation. They’re suggesting a “sell on rise” strategy in the near term for investors.

</span>Yet, the long-term predictions are still positive. As per Goldman Sachs and other financial experts, gold can reach ₹1,00,000 per 10 grams by 2027, based on reasons such as:

Central bank holding of gold reserves

Monetary instability

Possibility of a worldwide economic downturn in the coming years

Thus, while short-term investors may have to be cautious, long-term investors may find today’s prices an opportunity to enter.</span>

What This Means for Buyers

If you are purchasing gold for personal consumption—like, a wedding, festival, or gift-giving—this fall might be the ideal window. Prices may stay weak for several weeks, and if you move now, you can save some money.

Jewellers are also rolling out attractive deals and reduced making charges, making it even more appealing for buyers.

Investment Strategy: Buy Now?

Gold has forever been a stable hedge against market volatility and inflation. If you have a horizon of 2–5 years, now is perhaps a good time to begin building in small amounts through:

Gold ETFs

Sovereign Gold Bonds (SGBs)

Digital gold platforms

Physical gold (coins or bars)

For shorter-term investors, however, it’s advisable to watch the market and wait for more obvious indications before making substantial commitments.

Final Thoughts: Stay Informed, Stay Balanced

The gold price today is a topic of much debate, not only because of its recent fall, but also because of the greater financial and emotional value of gold in India. Whether you are purchasing jewellery or investing, knowledge of trends in the market can assist you in making wiser decisions.

In short:

Prices of gold have fallen following recent records

Experts predict increased market fluctuations in the near future.

Positive outlook in the long term

Buyers can find this a good time to make some purchases

Continue monitoring the market, diversify your portfolio, and make choices based on data as well as your own objectives. After all, when it comes to gold, timing is everything.

One thought on “Gold Rate Today – Why prices are falling?”